Property Investing made affordable with blockchain crowd investment platform BitofProperty

Investments in real estate have been historically unavailable or uneconomical to many looking to invest their savings, due to its complicated and capital-intensive nature. This is where Estonia and Singapore-based Property Technology (PropTech) startup BitOfProperty comes in: With their technology, they are digitally transforming the real estate industry to make property investing simple and enable people to invest in real estate starting from smaller amounts.

With rapid economic growth, better infrastructure and quality of life, Southeast Asia’s emerging markets are increasingly opening to foreign investment in property and real estate. At the same time, venture capital (VC) firms have also been increasingly investing in PropTech startups. This week with Techsauce, Karl Vään, CEO & co-founder of BitofProperty, shared his insights into the PropTech ecosystem, the role of blockchain in PropTech and the future of PropTech in Southeast Asia.

Karl Vään, CEO & co-founder of BitofProperty

Property investment made possible for anyone

“When it comes to investment of a portion of an income, people can choose to invest in stock market or cryptocurrency, but property is mostly out of reach. We want to help people break this barrier and allow them to embrace financial freedom”, says Karl.

Founded in Singapore with a subsidiary in Estonia, BitofProperty is a real estate investment platform that enables people to invest into property, starting from small amount and get the money from capital gain in the form of rental income. As the business is built on a crowdfunding concept, investors can invest with small amount as low as 50 Euros (2,000 Thai baht) for a single unit called BIT, in one or many properties. Once the target amount of a specific project is reached, investors then start receiving rental income according to their share of ownership. Essentially, anyone can invest in property.

Another value the platform brings to the table is, it connects property owners or developers with people who want to invest. This way, it also works as an online marketplace to connect two sides of customers.

Using technology to build an eco-system for real estate owners and property investors

The crowdfunding platform itself is built on the Ethereum platform, a ledger. Whenever an investor comes to the platform and make payment, this information is recorded on blockchain, bringing more transparency into the business deals and ownership of the properties, especially for overseas investors. Given that information is more easily accessible than ever, property owners now have the insight into which investors have the money to invest and how much money they are willing to invest, and can thereby target those investors accordingly. Likewise, investors also have access to information on the pricing and the development project of the property. This way, agents will also gradually be eliminated from the ecosystem.

When people buy from each other like on the stock market, movement of transactions is very fast and transparent. At this stage, even though blockchain is used, it is used in the form of fiat, in dollar or pounds, and not yet in bitcoins. But in the near future, users can use cryptocurrencies to trade.

Blockchain’s role in PropTech

People often have wrong understanding of what blockchain really is and would usually get blockchain mixed up with Initial Coin Offering (ICO), bitcoin, or other cryptocurrencies. Up to date, there hasn’t been that many companies in the blockchain space, especially in Southeast Asia. Nevertheless, these are the key things which can be enabled through application of blockchain:

- Smart contract: Helps with decentralizing ownership and transactions from peer-to-peer. On BitofProperty, whenever the crowdfunding campaign takes place, when some certain amount is hit, then automatically the ownership (essentially tokens) will be distributed to the investors.

- Access into investment and financing: Using the blockchain, usage can expand beyond just one platform. In this case, investors don’t have to just come to BitofProperty to invest, but they can also go to whichever company or platform to invest and expand their investment portfolio.

- Integration: Blockchain technology is also used to facilitate the marketplace features, allowing more ease when it comes to integrating with other platform and services. Blockchain allows connecting one platform to the other, and this will be much easier especially when the companies are using the same blockchain.

With blockchain as the foundation of the investment platform, investors can diversify their investment across different countries and have easy access to initial information and pricing about the properties not just locally, but also overseas.

Thailand as the entry gate to PropTech in Southeast Asia

When compared to many countries in Southeast Asia, Thailand is a great place to begin with given that property rules and laws are quite well-established, so it is safe for investment. Not only that, Thailand is also one of the most touristic destinations among its neighbouring countries in the region. Tourists from Europe, America and Australia surely know about Thailand, and the properties here can potentially attract investment from these people. Return on investment (ROI) of property in Thailand is also comparatively high compared to the rest of the region.

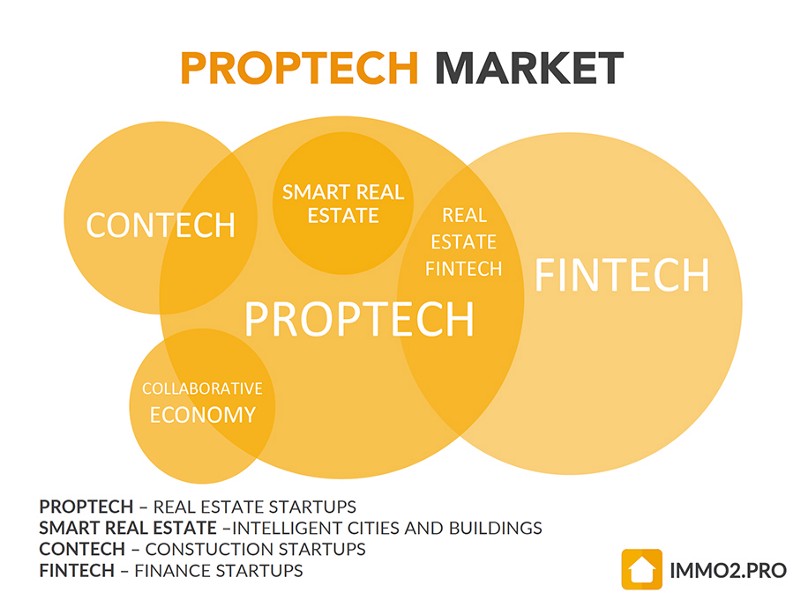

PropTech: an industry underinvested by VCs

While PropTech might not be the most interesting field for VCs at the moment, there are many rising PropTech startups out there determining to solve small problems in the niche market. Asia-Pacific (APAC) transaction volumes in the real estate market is forecasted to grow five percent, reaching US$135 to US$140 billion by end of 2018 and will be largely driven by continued momentum in core markets and increased interest in the region’s developing market, according to property services firm Jones Lang Laselle (JLL). PropTech market has infinite opportunities and so much can be done. In 5 years’ time, there will definitely be more companies looking into PropTech space.

Another reason for the seemingly unpopular funding in this field is that PropTech is often related to FinTech - there is a lot of overlapping. Even BitofProperty is considered a mixture of FinTech and PropTech. The overlapping and generic categorization might lead to different figures on statistics.

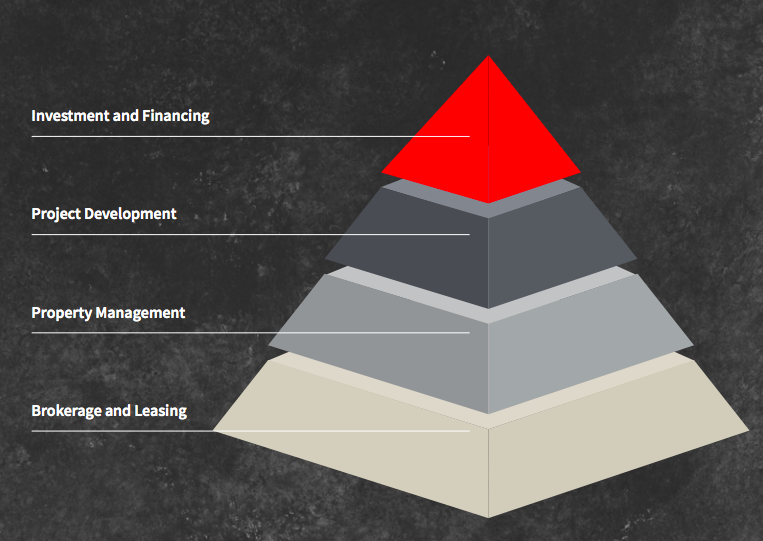

Catching the waves of PropTech

JLL PropTech Report 2018

The first wave is in the digital disruption of property leasing and brokerage business. The question is how technology can add value to the existing way of leasing and selling of properties, and how it can eliminate the “middle-man” (agents) while boosting efficiency in the transaction of property market.

The second wave is property management, which has already starting to emerge. A lot of startups and companies are coming in to change the way we manage properties. For instance, crowdfunding for properties has started since 2013, and has continued to grow.

The third wave is in project development, more specifically of how 3D, virtual reality (VR) and augmented reality (AR) technology come into play. 3D and VR are tailored more to help architects, brokers and buyers to better visualize a property, while AR is used to enhance customer experience and facilitate interiors customization. These technologies are also there to extensively help with the visualization of the building during the construction process, allowing an inside-out viewing.

The challenges faced by PropTech startups trying to enter Southeast Asia

- Rules & regulations: Coming to Thailand or any new market, entrepreneurs have to understand the laws and regulations in the crowdfunding space, making sure that they have the right license and are complying to the laws.

- Localization: Thai market is interesting and thrilling, but at the same time, buying and selling of property are very localized. What a startup would need is a local partner and knowledgeable local teams who know the market, the area, the prices and essential information revolving around the property businesses, and most importantly, someone they can trust.

- Language: This is always a key challenge for any business entering a market with a native language that is not English. There has to be a team which can operate administrative tasks in local language.

- Balancing the double-sided market: Having a similar business model to sharing economy adopted by AirBnb and Uber, any platform company has to ensure a balance on the supply side and demand side. In the case of BitofProperty, it is essential to balance the numbers of investors with the numbers of property owners.

The Future of PropTech industry

There is so much that can be done in this space. The property industry will be more digitalized in many areas, starting from buying and selling, user experience (3D and VR), to construction development and property design. The role of real estate agent and broker will change and have less impact on the society. It will be more about user engagement. Even in construction, the process will change as architects and construction companies utilize technology to disrupt the traditional processes.

About BitofProperty

Earlier this year, BitofProperty has closed seed round financing with lead investor, LIFULL Co, a Japanese real estate company, following a pre-seed round led by Spaze Ventures, a Singapore-based start-up incubator. Currently with Japanese and Estonian properties on their platform, they are looking to add Bangkok property in early 2019.

Sign in to read unlimited free articles

.png)