Idinvests Partners: The Pros and Cons of Deep Tech

Techsauce was honoured to be invited by Digital Ventures to participate in the U.REKA Batch 2 press conference. Mr Julien Mialaret, the operating partner from Idinvests Partners, introduced the pros and cons of Deep Technology at the conference.

Idinvest Partners is a global company that invest in deep technology across the globe. As a sole investor, he believes that deep technology does not require a big market, which signals an opportunity for countries like Israel, Thailand and Singapore.

Idinvest focuses on regional corporates like Allianz, EDF, Singapore Power, Changi Airport etc. He strongly believes that corporates are essential in this investment as it is playing a major role. Hence, he wants to maintain and build the bridge between Venture Capitals (VC) and Corporates. Idinvest Partners' main priority is to show corporates the global market, allowing them to see target markets in the global picture.

Idinvest Partners is the largest investor group in Europe and currently managing about €8.1 billion now (Venture Capital €3 billion). They are present globally – Europe, Singapore, New York, China, Sao Paulo. Idinvest invests in all stages in businesses. When investing at a later stage, they focus on how businesses work. Vice-versa, when investing early, they provide projections to the entrepreneur and provide equity and debt to the business. In addition, they also invest in all sectors - Smart City (Deep tech, Energy, mobility)

Definition of Deep Tech:

Mr Julien pointed out 3 main problems about technologies:

Deep Technology: In its early stages, deep technology is a solution waiting to solve a problem. A lot of technologies are in universities, there is uncertainty on how to apply it to business models.

Main Problem: How to sell the technology/ solution [Business Model] question

Profound shifts - Fundamental technology: Deep Technology is looking for a fundamental shift, not an incremental one. People have the misconception that it is working towards incremental overtime, but it is fundamental.

Main Problem: Not always scalable, it’s a robot/AI.

Developed and launched by scientist: As one of the fundamental issues, these deep technologies applications are developed by scientists, not entrepreneurs. They do not have the skills and mindset of an entrepreneur hence unable to maximise potential of Deeptech.

Main Problem: Unable to maximise the potential of Deeptech

Why Deep Tech

Reason for Deep Tech:

Reason for Deep Tech:

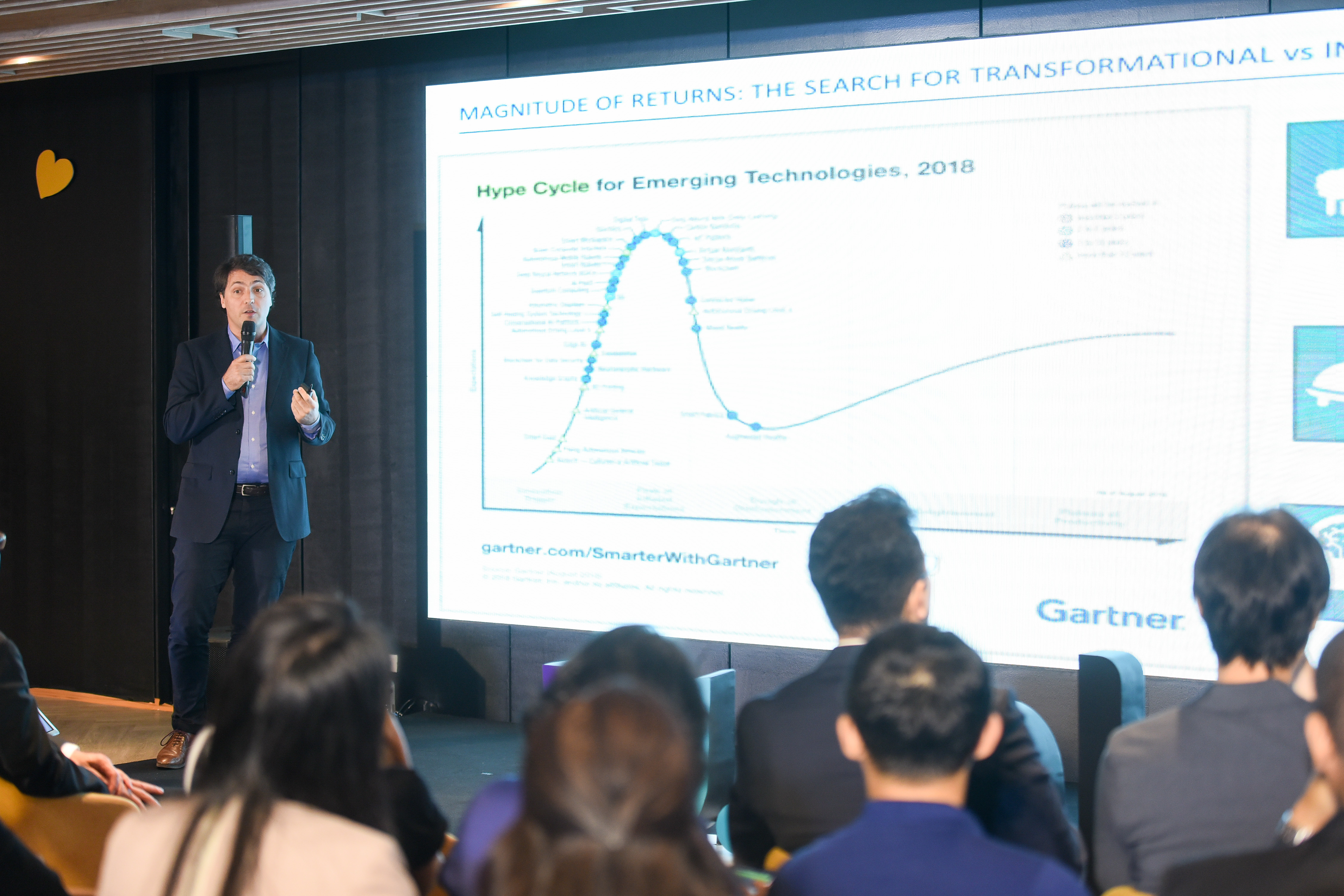

- Investors - looking for Magnitude of Returns, not looking for incremental return. They are looking for a much bigger fundamental returns.

- Corporates - picking up deep tech early + build Interventional pulmonology (IP) chest (to create their future). This externalise their Research & Development (R&D)

- University - Capacity building (remain competitive)

How Deep is your Tech

Top investment

- US

- China

- Europe

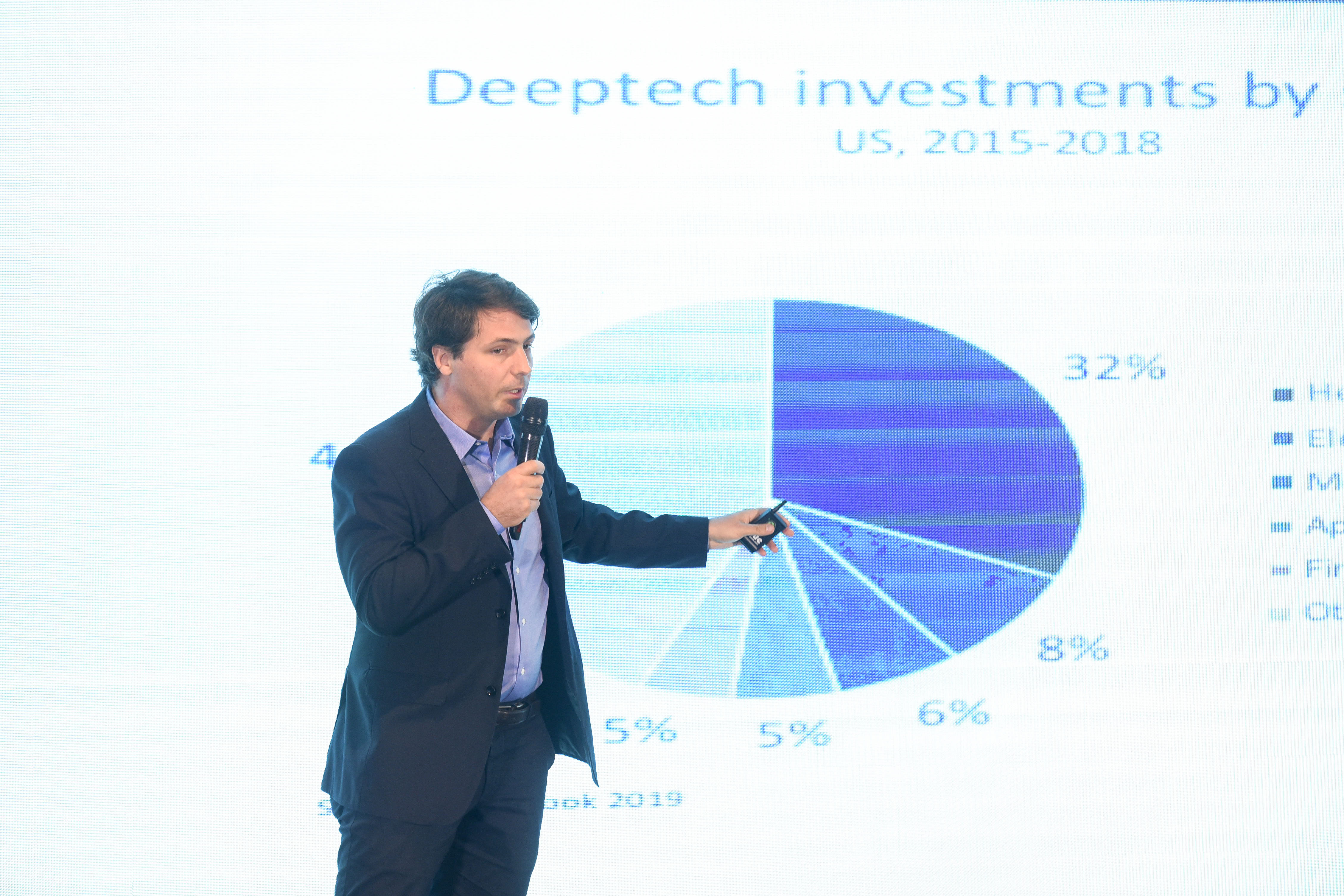

United States: Deeptech investment by various sectors eg, Healthcare & biotech, Electronics, Mobility, Application Software, etc

Driver of investment - GAFA (private money from Google, Facebook, Amazon), Government investment.

Main areas of focused programmes: AI, Genomics, SpaceTech, AR/VR, Cybersecurity.

Poster boy: 23andMe, SpaceX

Europe: Smaller in investment volume - harder to invest. Europe sectors are much more diverse as compared to the US (huge investment come from Finance 55%)

Driver of investment - Government Program (€800m), EU Programme (€77bil), Universities.

Main area of focused programmes : Energytech/IoT, Genomics, AI, Quantum Computer.

Poster boy: DeepMind, sigfox

China: A massive market, where there is massive growth in investment - most data in AI, converting deep tech (core tech) into application faster than anyone.

Drivers of investment - very huge government funds, huge VC funds, investment from Huawei, Xiaomi, Baidu etc

Main area of focused programmes : Leading AI (because of the huge volume of data), computer/chips, Autonomous system, Blockchain.

Poster boy: Sensetime, Horizon Robotics (producing the chips)

Main corporate investors:

In US - GV, Intel Capital

In EU - Novo Holdings, Robert Bosch Venture Capital

In China - Tencent Holdings, Baidu Venture

The importance of their massive role:

New innovation model - Corporate cannot do the R&D alone, they need to work with start-ups.

Deep dives - Taking one sector and look across the world, taking Corporates (R&D Team) and Venture Capitals (network with entrepreneur) to work together for advancement and progress to gain both financial rewards and strategic values.

Idinvest help corporates invest, manage fund for large corporate and work with corporate team's business units. VCs will help them build business units, build JVs, and train them.

Future Trend: VCs and corporates working together to invest in early tech, each bringing their capability to find the best company globally.

Deep trouble

Deep tech is not just about the technology, is how you find them and the problems you solve. Deep tech is very difficult to build business, it’s possible, but there’s definitely problems you need to solve. - Julian Mialaret

Challenge: Finding the right roadmap - E.g Neurala

Neurala came out in NASA. They Built AI software that was for the MARS Rover. They have a powerful AI technology the problem they faced is they are unsure of which application to sell, how to use it to the fullest potential. How do you monetize? Neurala started as a competitor of Google. They gone from providing AI for NASA, to using this AI for one specific application - Video Tagging. When processing a massive amount of videos, we need to tag these videos to say what's in this video, and we can use AI to do these. Neurala provide a massive amount of them in value. This is a concrete example of an entrepreneur that has a powerful technology but they do not know how to apply it or sell it.

Challenge: Turning scientist to entrepreneurs - E.g Trust in Soft

Trust in soft is a company that analyse core source code. They take codes and automatically analyze the code to see if there’s an error or flaws. Trust in Soft plays a very important role especially for autonomous vehicles like IOT. If there's a flaw in the source code, these objects will be hacked. These technology ideas came out from universities professors, not entrepreneurs.

Challenge: IP Protection & Business Model - E.g WeRide

WeRide is the first taxi service in Guangzhou, China with no taxi drivers. Right now there is 30 taxi that is driverless, and they are aiming to attain 500 people. The challenge here is what does this company do? Does it sell system to DiDi (China taxi company) or does it become a taxi service itself? There is a business problem in terms of resources. Main advantage is there’s a lot of technology, but how to protect it.

Challenge: High Volume Production - E.g Sunfire

Sunfire, energy sector in Germany. If you have electricity, you can produce hydrogen through an electrolyser or if you hydrogen or methane, you can produce electricity through fuel cells that doesn’t emit CO2. It’s a very powerful system, but the problem here is they need volume. The cost of fuel cells per units is too expensive. How do Sunfire ramp this up? It requires a lot of manufacturing capabilities which they do not have it in german.

Sign in to read unlimited free articles

.png)